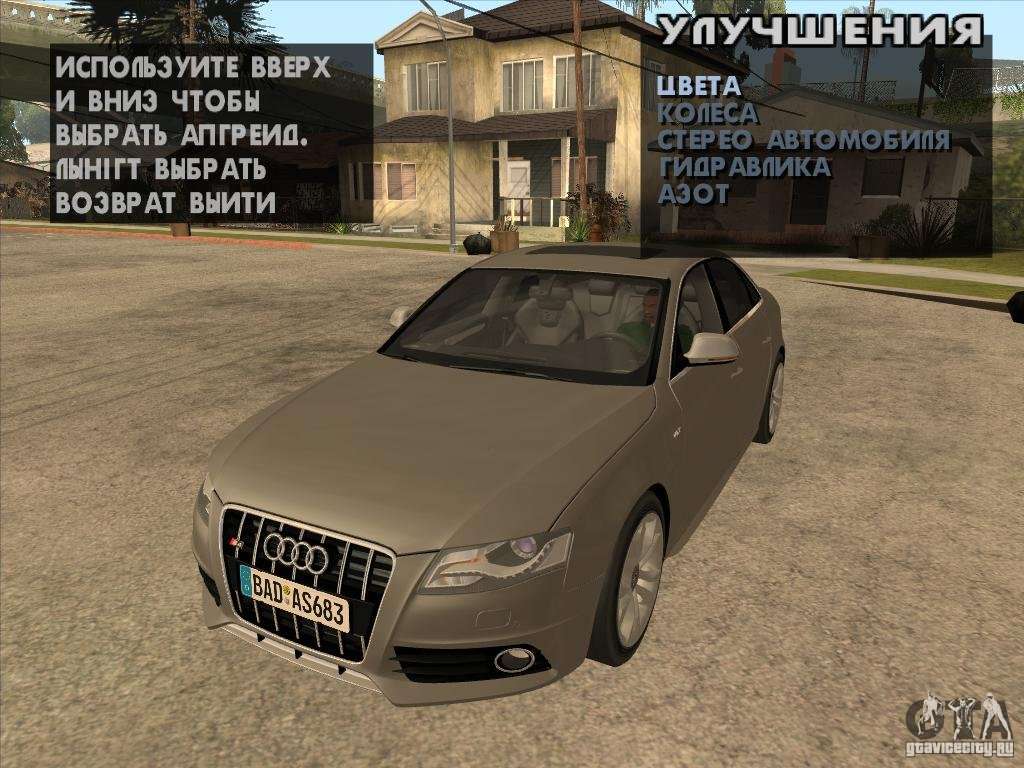

Kodi Na Gta San Andreas Super Kars Na Russkie Mashini

Synopsis: The Roth 401(k) shares features of both the Roth IRA and regular 401(k) plans. Perhaps the biggest difference between regular 401(k) plans and Roth 401(k)s is that employees can contribute after-tax dollars in a separate account where the assets can grow and be withdrawn tax free. But there are differences between the two employer-sponsored plans that need to be considered. For instance, if you anticipate making a job change or retiring in the near future, you’ll want to pay close attention to the rules governing distributions from Roth 401(k)s. This article looks at the key issues surrounding distributions from and rollovers of Roth 401(k) plans. The Roth 401(k) resembles the Roth IRA, in that contributions are made with after-tax dollars and qualified withdrawals can be made tax free.

Marina and the diamonds acoustic album download. Early on, she claimed that her inspirations were Britney Spears and Gwen Stefani -- who she often covered at live gigs -- but her songs have a soulful edge pointing to a deeper source of influence.

Sentinel 827 Stretch 131 Sultan 1636 Super GT 411 Taxi 303 Turismo 365 ZR-350 363. Mini for GTA San Andreas, page 1. Model; Clubman 2 Concept 1 Cooper 30 Cooper S 8 Countryman 4 Coupe 1 GT 1 Miglia 1 Minor 1 Apply 0 Mini Concept Coupe 2010. GTA San Andreas —. Mar 29, 2015 - chit-kodi-na-gta-liberti-siti-psp chit-kodi-na-gta-liberti-siti-s-vertolt.

But, as the name implies, it also shares many of the rules affecting traditional 401(k) plans.The Roth 401(k) resembles the Roth IRA, in that contributions are made with after-tax dollars and qualified withdrawals can be made tax free. But, as the name implies, it also shares many of the rules affecting traditional 401(k) plans.

If your employer offers a Roth 401(k), there are rules concerning this retirement saving vehicle that you should be aware of. In particular, if you anticipate making a job change or retiring in the near future, you’ll want to pay close attention to the rules governing distributions from Roth 401(k)s — how they differ from regular 401(k)s and how they are the same. Does Your Roth Distribution Qualify for Tax-Free Treatment? Like the Roth IRA, distributions from a Roth 401(k) are generally tax free and penalty free if the owner meets certain requirements. Specifically, distributions must be made: • After the participant reaches age 59½ or in the event of the participant’s death or disability, and • After the participant has held the account for at least five years. This applies even in cases where the participant has retired.

18 Kopejsk city RUSSIAN FEDERATION phone: +7 9 fax: e-mail: Areas serviced: RU Apart from agreed Internet operational purposes, no part of this information may be reproduced, stored in a retrieval system or transmitted, in any form or by any means (electronic, mechanical, recorded or otherwise), without prior permission of the RIPE NCC. Plotnikov Evgenii Viktorovich PE Lenina str. Gotovij dnevnik po pedagogicheskoj praktike biologiya 18. Any use of this information to target advertising, or similar activities, is explicitly forbidden and may be prosecuted.

Although distributions may be permitted if one or more of these qualifications is not met (“nonqualified distributions”), tax-free and/or penalty-free treatment is reserved for “qualified distributions” as described above. What Are Your Roth Rollover Options? For employees who leave a job where they had been contributing to a Roth 401(k), the IRS provides two choices for managing those assets: roll the account balance into another retirement plan that accepts such rollovers, or roll the account into a Roth IRA. Both options generally have no tax consequences.